how to calculate sales tax in oklahoma

Oklahoma Sales Tax Calculator You can use our Oklahoma Sales Tax Calculator to look up sales tax rates in Oklahoma by address zip code. The Oklahoma state sales tax rate is 45.

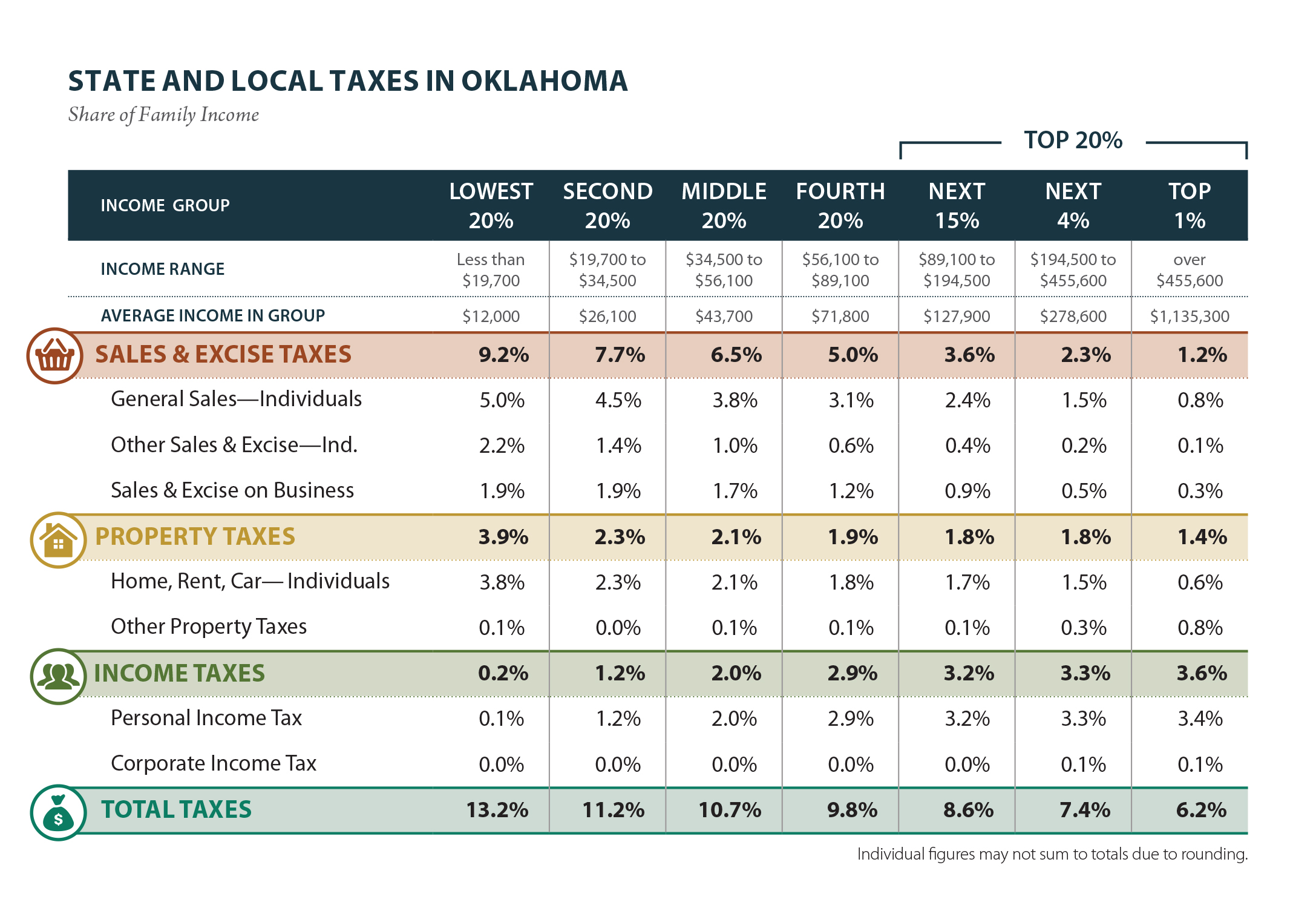

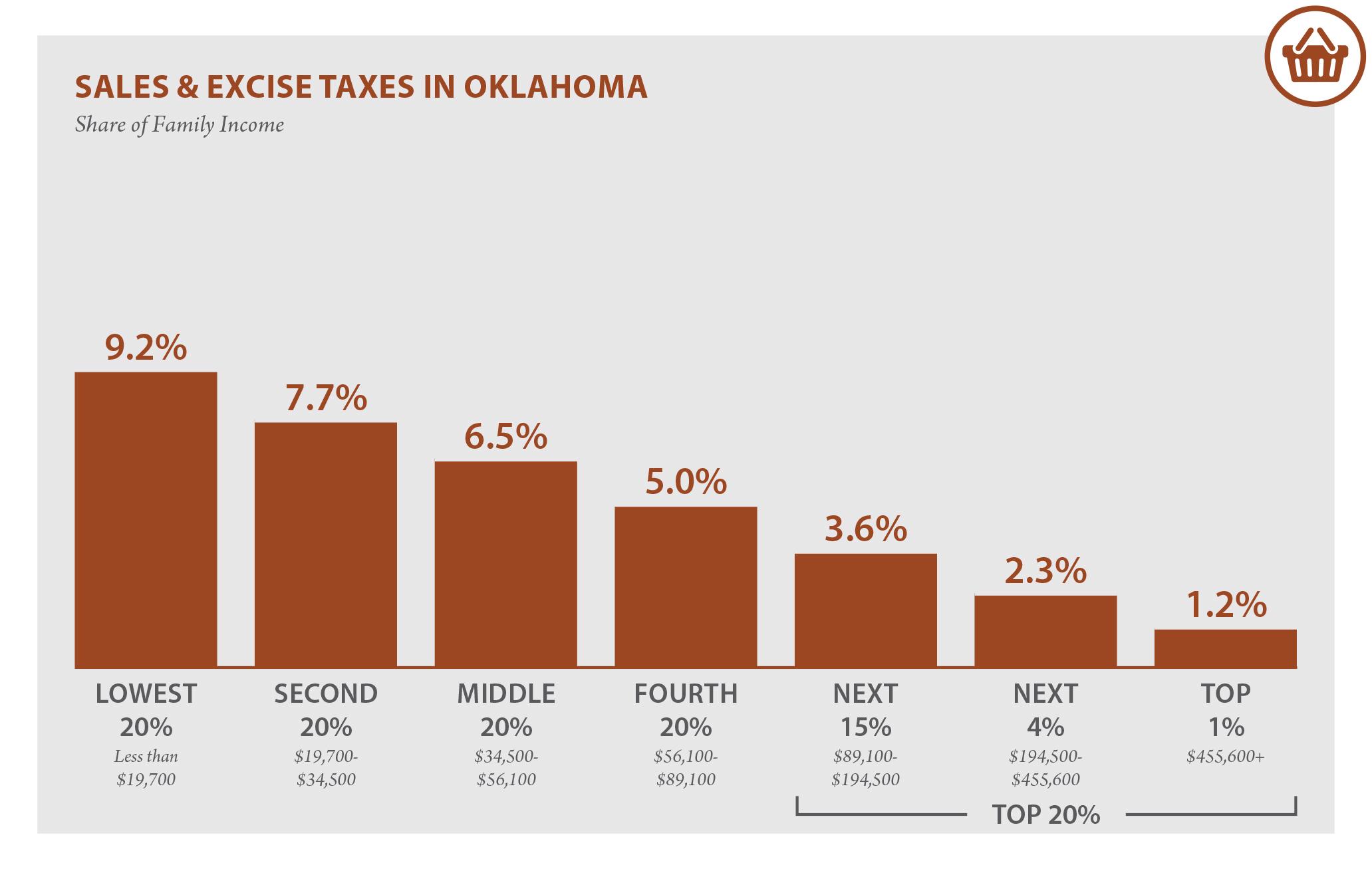

Oklahoma Who Pays 6th Edition Itep

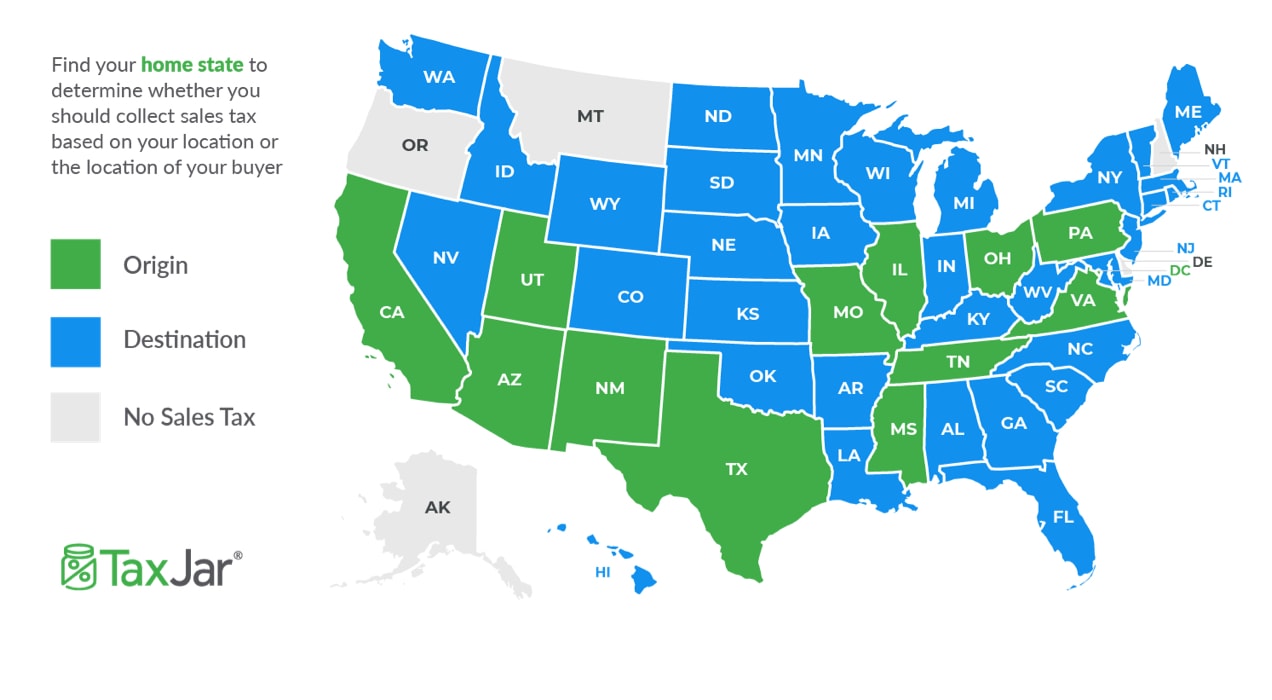

If you are based in Oklahoma and selling to a buyer with a ship to address in Oklahoma charge sales tax based on the sales tax rate at the ship to.

. The excise tax for new cars is. The oklahoma city sales tax rate is 8625 taxing jurisdiction rate oklahoma state sales tax 450 oklahoma city tax 413 combined sales tax. However in addition to that rate Oklahoma has.

In addition to the 125 sales tax buyers are also charged a 325 excise tax on all new vehicle. Typically the tax is determined by. To know what the current sales tax rate applies in your state ie.

The excise tax for new cars is 325 and for used cars the tax is 2000 for the first 150000 and 325 on the remainder of the sale price. Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. Avalara can help your business.

Oklahoma Income Tax Calculator 2021 If you make 70000 a year living in the region of Oklahoma USA you will be taxed 11520. How to Calculate Oklahoma Sales Tax on a New Car To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. This includes the rates on the state county city and special levels.

Oklahoma Sales Tax. In Oklahoma this will always be 325. Use the sales tax formula below or the handy calculator at the top of the page to get the tax detail you need.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Oklahoma local counties cities and special taxation. How do you calculate sales tax. Oklahoma are not assessed Oklahoma excise tax provided they title and register in their state of residence.

However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in the usual way. You are able to use our Oklahoma State Tax Calculator to calculate your total tax costs in the tax year 202223. Oklahoma all you need is the simple calculator given above.

Ad Have you expanded beyond marketplace selling. Avalara can help your business. Item or service cost x sales.

Oklahoma City Oklahoma Sales Tax Calculator Before Tax Amount 000 Sales Tax 000 Plus Tax Amount 000 Minus Tax Amount 000 Enter an amount into the calculator above to find. Multiply the cost of an item or service by the sales tax in order to find out the total cost. Enter the Amount you want to enquire about.

To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. Ad Have you expanded beyond marketplace selling. Sales tax on all vehicle purchases in Oklahomaeven used carsis 125.

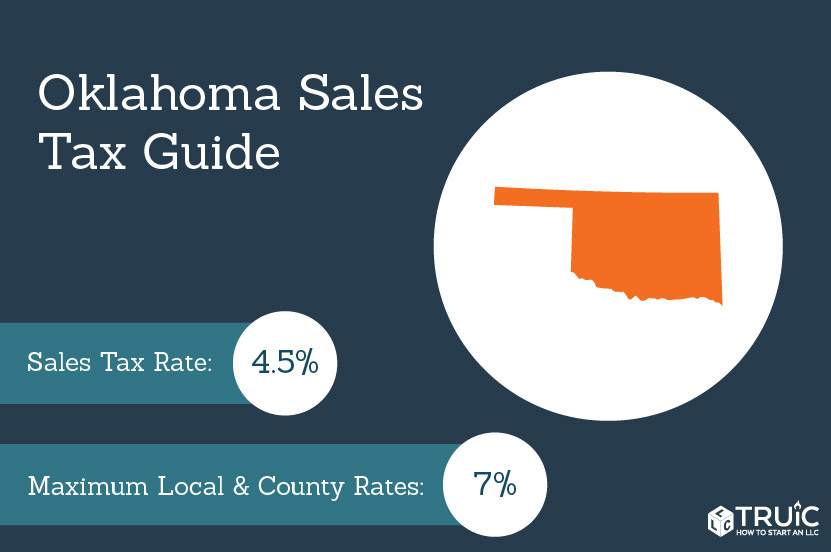

Sales Tax Calculator Calculate Before Tax Amount 000 Sales Tax 000 Plus Tax Amount 000 Minus Tax Amount 000 Enter an amount into the calculator above to find out how. Oklahoma state sales tax rate range 45-115 Base state sales tax rate 45 Local rate range 0-7 Total rate range 45-115 Due to varying local sales tax rates we strongly. Tulsa has parts of it located within Creek County Osage.

Oklahoma Sales Tax Rates information registration support. The calculator will show you the total sales tax. Multiply the vehicle price by the sales.

The average cumulative sales tax rate in Tulsa Oklahoma is 831. The equation looks like this. Alone that would be the 14th-lowest rate in the country.

In Oklahoma this will always be 325. Sales tax total amount of sale x sales tax rate Wise is the cheaper faster. Your average tax rate is 1198 and your marginal.

Use our OkCARS - Sales and Excise Tax Estimator to help determine how much. Ad New State Sales Tax Registration. Our calculator has recently been updated to include both the latest Federal Tax.

The state sales tax rate in Oklahoma is 450.

How To Register For A Sales Tax Permit In Oklahoma Taxvalet

Oklahoma Sales Tax Handbook 2022

State Corporate Income Tax Rates And Brackets Tax Foundation

How To Charge Your Customers The Correct Sales Tax Rates

Car Tax By State Usa Manual Car Sales Tax Calculator

How To Charge Your Customers The Correct Sales Tax Rates

Oklahoma Sales Tax Small Business Guide Truic

Sales Tax Guide For Online Courses

Amazon Sales Tax What It Is How To Calculate Tax For Fba Sellers

What Is Sales Tax A Complete Guide Taxjar

Oklahoma Who Pays 6th Edition Itep

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation